Global head battery companies compete for the "tuyere" of energy storage in the United States

AddTime:2021-07-26 Author:Xinyuren Hits:3029

The U.S. energy storage market has a strong growth momentum, and the global head battery enterprises have been laid out one after another.

In 2020, the United States deployed a total of 1464mw / 3487mwh energy storage system, with a year-on-year increase of 179% based on the installed capacity. This exceeds the cumulative deployment of 3115mwh from 2013 to 2019.

Industry analysts believe that this is a sign that the U.S. energy storage market has begun to show exponential growth, and this momentum will strengthen in the next few years. It is predicted that by 2025, the installed capacity of energy storage system deployed in the U.S. energy storage market will increase five times.

Due to the continuous decline in the cost of energy storage system, increasing policy support, and the regulatory reform of the federal and state governments, the U.S. energy storage industry is on the track of accelerated development.

According to the data, it is expected that the global new operation scale will leap in 2021, reaching 9.7gw/19.9gwh, breaking the 10GW mark in 2022 and 13.8gw/29.4gwh in 2023. From 2021, the United States will take the lead, accounting for 41% of the global energy storage deployment.

Although the market is broad, the threshold for entering the American market is high. For example, there are strict requirements for energy storage product standards and system design capabilities, and products usually need to be certified (such as UL 9540a).

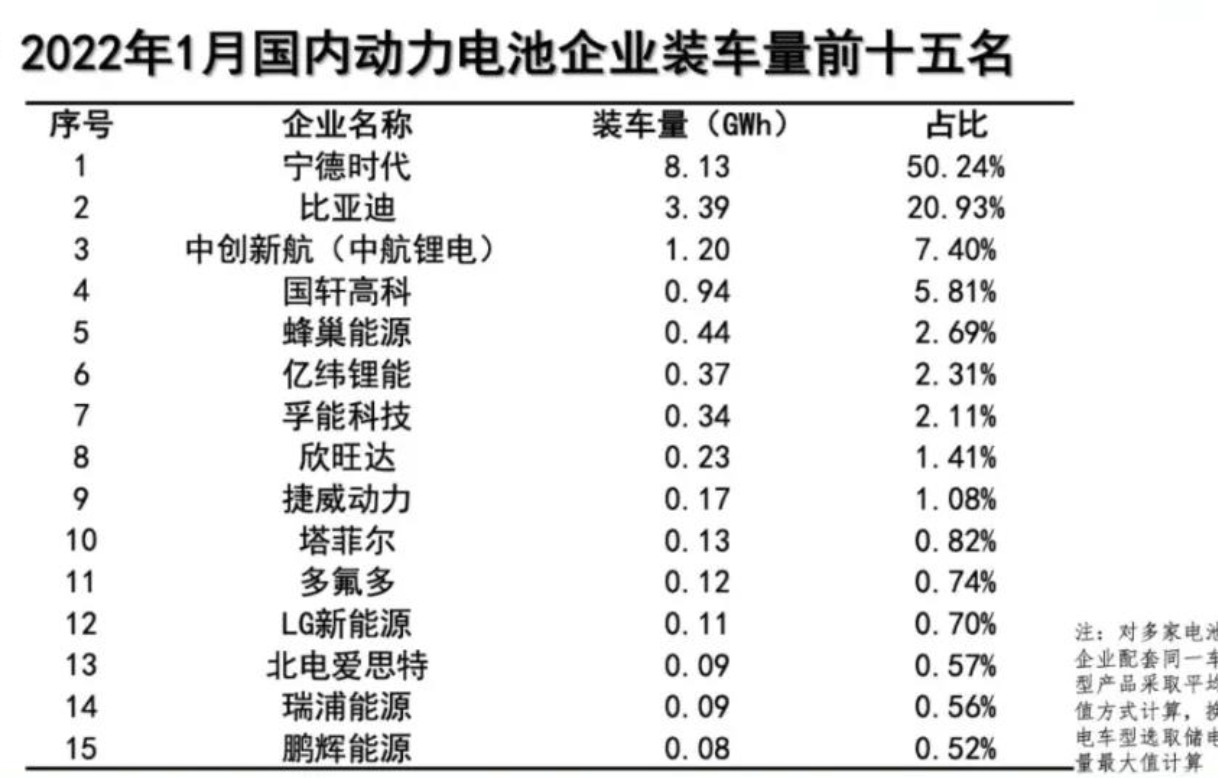

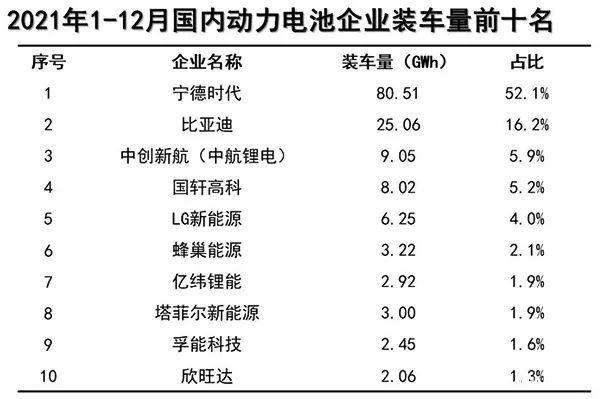

At present, among the participants in the U.S. energy storage lithium battery market, domestic leading battery enterprises mainly include Ningde times, BYD, GuoXuan high tech (Shanghai Electric GuoXuan), Yiwei lithium energy, etc., and foreign countries include LG new energy, ski, Samsung SDI, etc. In terms of technical route, ternary is mainly used in foreign countries and lithium iron phosphate is mainly used in China.